DEBITUM TECHNOLOGY BASED ON BLOCKCHAIN

The Debitum Network strives to meet the needs of small and medium-sized businesses, especially in developing country Indonesia, which lack access to credit due to the lack of financial systems. Data compiled by the World Bank show large financing gaps still exist have never been met by traditional banks or alternative financial providers Because of their size and risk aversion are supported.

With strong regulations, traditional banks prefer larger clients with lower credit risk, and neglect small and young companies. The Debitum Network implements blockchain technology to overcome barriers and creates this global ecosystem that connects small businesses with global capital resources.

Network Debitum vs. other fintech ICOS

▪ A number of ICOS successfully completed has presented a blockchain based loan solution. However, in many cases, their market coverage is limited to borrowers or investors already

holds blockchain assets, which limit their current and scalability in the near future.

▪ By comparison, the Network's debitum addresses a large market of underbanked businesses in developing countries, and can serve their needs regardless of their currency choice

or available collateral.

▪ In addition, in contrast to other blockchain-based lending platforms, Network debitum combines the provision of loan-related services by different counterparties,

a truly decentralized and valuable ecosystem.

▪ The table below shows how Network discharge comparing with ICOS is the most prominent in the financial sector.

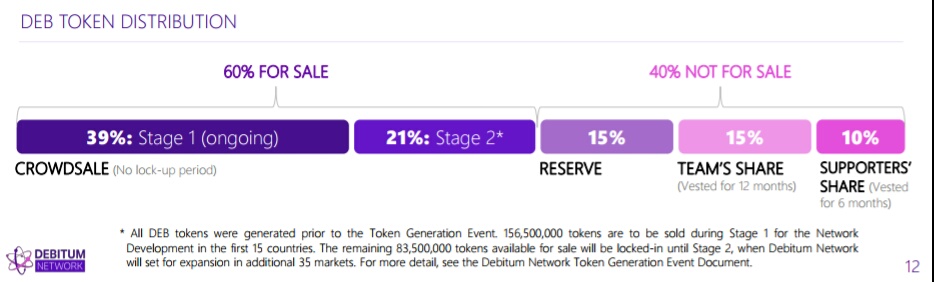

DEB TOKEN DISTRIBUTION

Use of proceeds

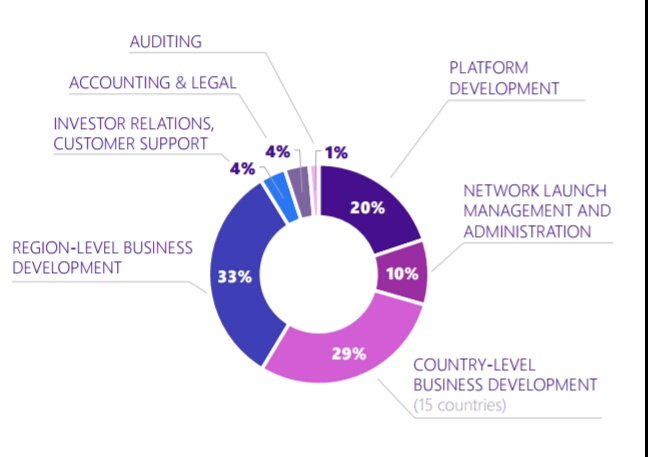

▪ The following graph displays the breakdown of use of proceeds for Debitum Network development in Stage 1, following a successful completion of the crowdsale.

▪ In the graph, network launch management and administration include costs for the general management, HR management and necessary administrative expenses.

▪ Country-level business development includes onboarding service providers, setting up communities, attracting borrowers, etc., in each country.

▪ Region level business development stands for onboarding regional partners and coordination of activities within the region (e.g. Southeast Europe, CEE).

▪ The use of proceeds is outlined for 5 years, afterwards the operations of the platform shall be self-sustaining.

MARKETS LAUNCHED

The remainder of tokens to be sold to general public will be sold in later Stages of

Crowdsale to fund Debitum Network expansion into new markets - steps 3 and 4.

The remaining 40% of Debitum tokens will not be sold to the general public

and will be vested (unavailable for trading in the secondary market for defined

periods of time). 10% of Debitum tokens will be distributed to Debitum

Network advisors and contributors. These tokens will be vested for 6 months.

15% of Debitum tokens will be distributed to the Debitum Network team

founders, technology developers, ecosystem developers and multiple other teams

members. These tokens will be vested for 12 months. The other 15% of Debitum

tokens (60,000,000 tokens) will be stored in Reserve.

To proceed with the development and launch of Debitum Network, the minimum

required contribution equivalent to 1,200,000 USD was collected during Round A

of the Stage 1 Crowdsale. A contribution of this size will allow us to develop and

launch the basic functionality software, onboard the initial ecosystem participants

in at least one market where the SME credit gap (lack of financing for small and

medium businesses) is indicated by the World Bank organization as being worst.

The Stage 1 Crowdsale hard cap is split between Round A (4 000 ETH) and Round B

(20 000 ETH), the funds needed to develop Debitum Network to a full production

version. Furthermore, we'll be able to launch our home market - Europe, ensuring

the initial success of the ecosystem. However, it would not bring immediate self-

sustainability and would take more time to reach it. The ecosystem

we're building requires many connections to the legacy world and a considerable

international presence to succeed. This means that with the development of the

Debitum Network ecosystem, moving from Stage 1 development to Stage 2 and

Stage 3, we will conduct additional sale to sell the remainder of Debitum tokens

meant for general public. For more details please see our Action Plan / Use of

Proceeds.

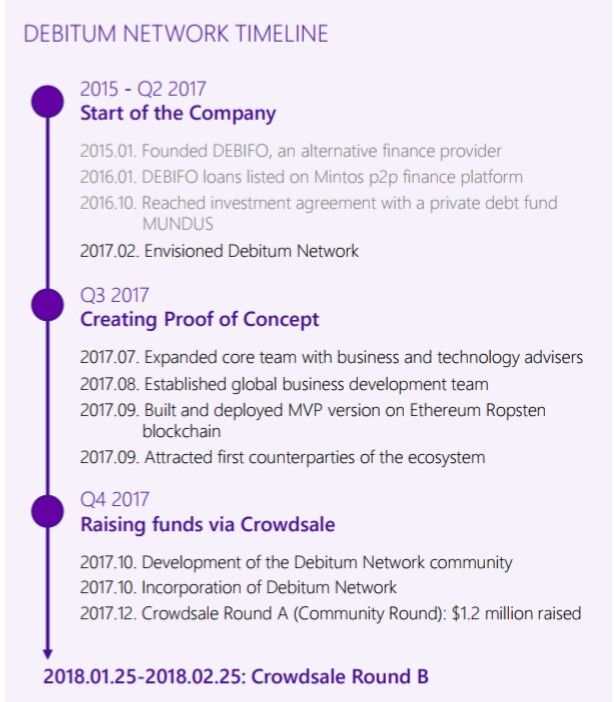

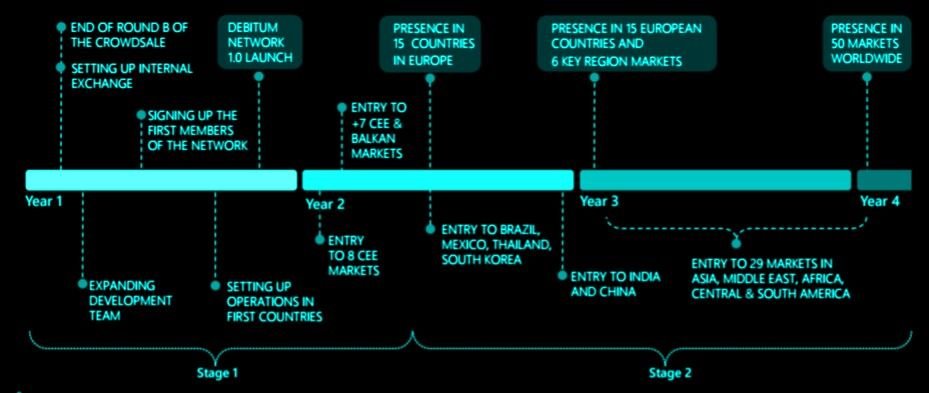

DEBITUM NETWORK TIMELINE

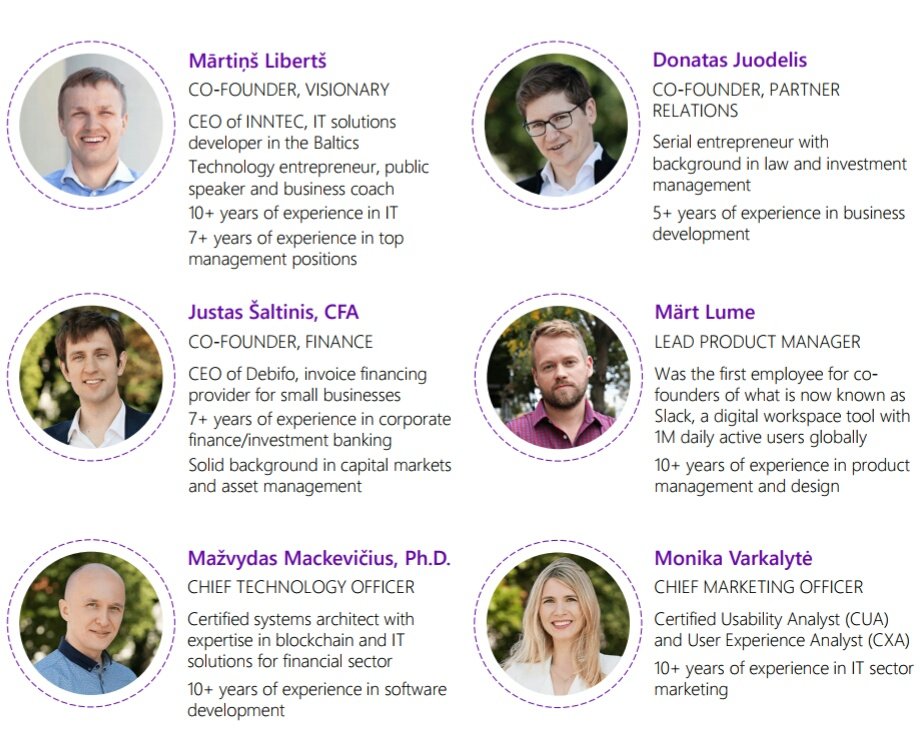

The core tea

▪ The founders of Debitum

Network are passionate

entrepreneurs with solid

background in their fields

.

▪ In addition to core management,

Debitum Network has set up

a

team of developers and business

development managers, who are

already working on the

deployment of the platform

.

▪ Debitum Network aims to keep

its team small, consisting mainly

of developers and country

managers for the launch of the

platform in different markets

.

▪ Over time, Debitum Network

shall be able to operate

independently of the initial

development and management

team

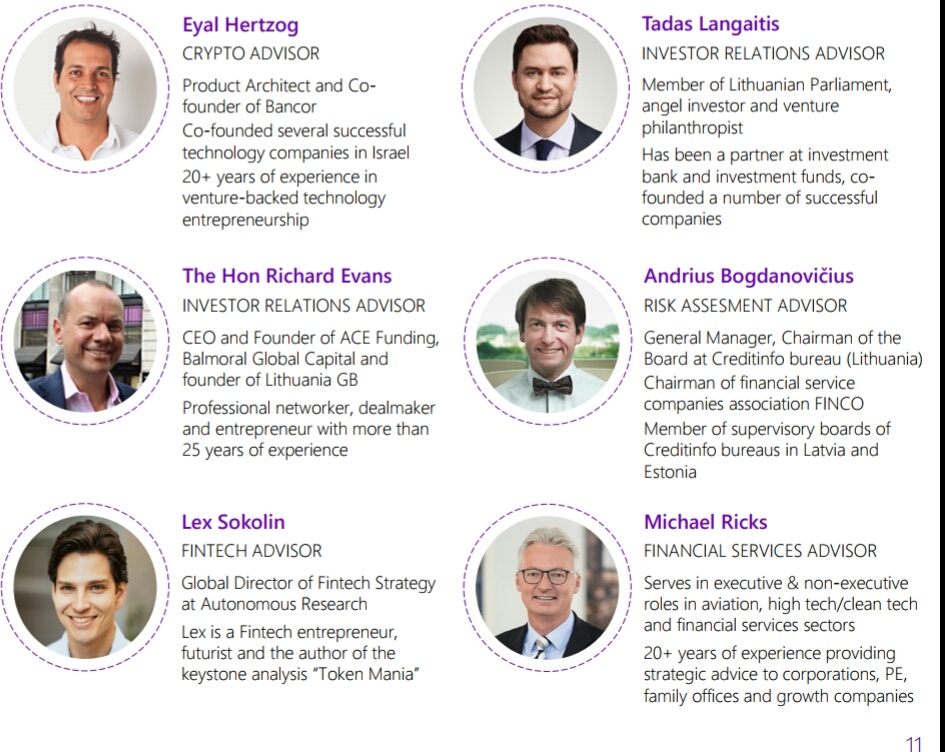

Advisors

▪ Debitum Network has attracted

a

solid advisory board of

experienced professionals

. Part of

They are presented on this page

.

▪ All members of the Advisory

Board have previously co

-founded

successful companies and served

in executive roles

. Their

comprehensive knowledge and

expertise in business development

and financial services will be

a

valuable element in fostering the

growth of Debitum Network

.

▪ Several board members have

been highly involved in

developing financial technologies

and already have accumulated

experience in issuing crypto

currencies

.

▪ The remaining members of the

Advisory Board have been

entrusted to advise on legal

matters, international business

development and marketing.

ROAD MAP

▪ Debitum Network has already raised $ 1.2 million, sufficient for initial product development and launch in the first market.

▪ Upon successful completion of Crowdsale Round B, Debitum Network will pursue Stage 1 expansion: setting up the ecosystem in 15

countries across Central and Eastern Europe (CEE) and Balkan region.

▪ The Stage 2 represents expansion into 4 major geographical regions outside Europe. Overall, Debitum Network seeks to establish

operations in 50 countries with the worst indicators for access to credit.

Further information:

Website: https://debitum.network/

Twitter: https://twitter.com/DebitumNetwork

Facebook: https://facebook.com/DebitumNetwork

Bitcointalk (Peot) : https://bitcointalk.org/index.php?action=profile;u=1137199

My ETH: 0x4870A7b246B1C2dF4e6749ac352c8f932B21304e

Komentar

Posting Komentar