GOLDMINT! ICO SALE ALERT! BLOG ULTIMATE TO CRYPTO MARKET

.jpg)

Take this very seriously, I will write something about it later in this article below to know the importance of it. The MNTP flag is in great demand. Every body is waiting for the upcoming sale open date. So subscribe yourself to the white list signup notification here:

https://goldmint.io/ico

The Internet has been filled with ICO offer advertisements from so many beginners, almost all new ventures launch their projects with blockchain technology, especially in services such as Trading, Real Estate, Fashion, Shopping, Softwares etc. So people are confused. about which token to buy, which to the left. For big investors, it's okay, they can make their investment across all selective tokens in a variety of ways. But what about a small investor like me, who can not buy at all average ICO openings. So it's all about to keep informing them, those who have a small budget and try to invest in crypto. Everyone presents in such a way as to prove it, that's the best. So under these conditions it is very difficult to make a decision to buy the right one. There are very few who can survive and keep their numbers above 100 coins and tokens. There is much more that needs to be done in this emerging industry in the 21st century. Finally I find this project very interesting in the area of blockchain innovation. Maybe some other people are also working on the idea of introducing a supported Gold Crypto Coins but I have not found it yet. Given this, I am writing this review as an article here to support GOLDMINT startup in the following paragraphs.

What is GOLDMINT?

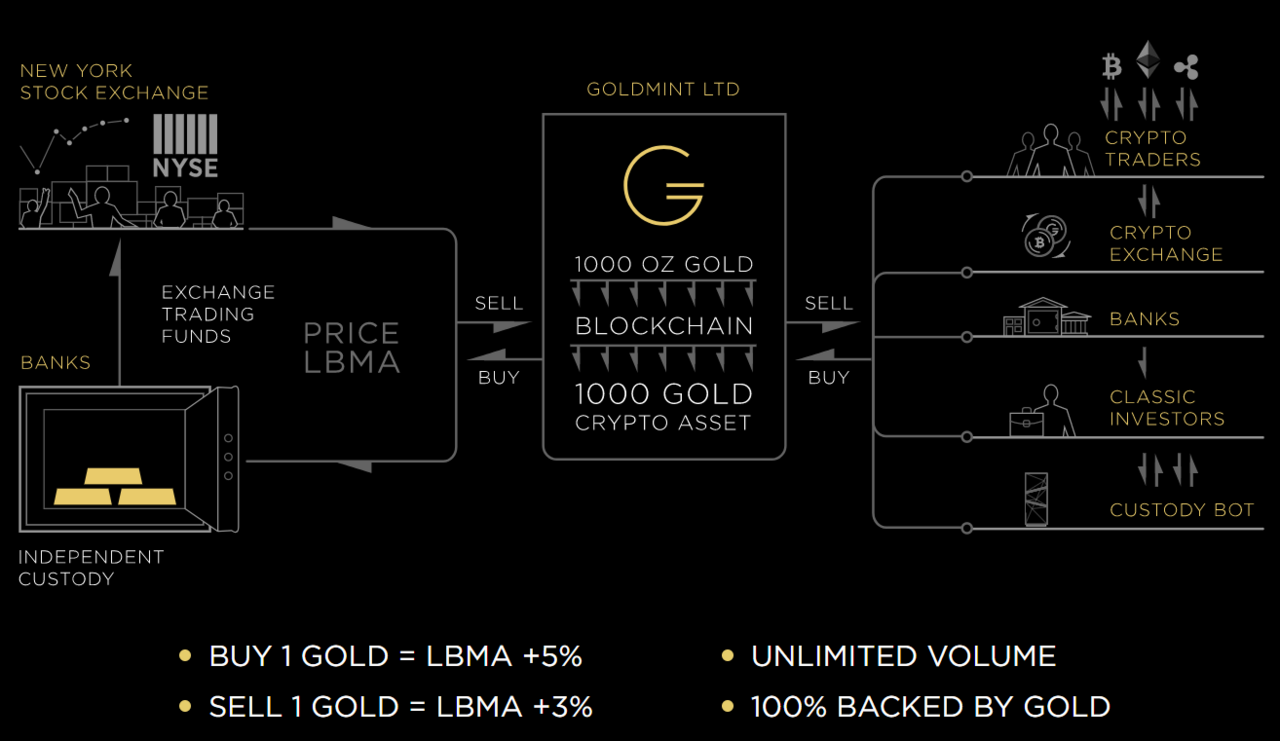

GoldMint buys, sells and repurchases GOLD at current market prices for physical gold. The Company uses exchange traded funds (ETF) or physical gold (999 qualities) as its safety. GoldMint gold reserves are equal to or exceed the amount of gold mined.

The difference between GoldMint and other gold cryptococcus blocks includes the following:

GoldMint uses its own blockchain and altcoin, called MNT, for GOLD transactions.

GoldMint uses Proof-of-Stake where miners handing out blocks / transactions according to the number of MNTs they have. The stock evidence (PoS) is faster, simpler and less expensive than the proof of work (PoW).

Physical gold and ETFs are stored in a programmable decentralized storage unit.

Custody Bot - GoldMint's innovative storage unit is programmed to automatically identify and store gold jewelry, small ingots (up to 100 grams) and coins, without human intervention.

Characteristics of GOLD cryptos include:

100% transparency information about all gold held by GoldMint, disclosing the company's gold reserves and its ability to repurchase GOLD on current trading prices.

GoldMint uses decentralized blockchain for smart contracting and for storing its cryptassasset.

GoldMint uses ETF for its liquidity and elasticity. ETFs help you exchange gold much faster than physical gold.

Secured loans may contain gold, such as jewelry or coins. GoldMint helps you keep this guarantee in a unique Storage Bot.

Ability to receive passive income as the market price of GOLD increases.

GOLD repurchase for fiat matches current GOLD pricing.

Fast registration and user identification system.

The GoldMint platform includes:

Blockchain itself uses GOLD and MNT cryptoasset.

Programmable safe deposit - ie, Custody Bot.

Application Programming Interface (API) to build application software and to help software components interact.

Target market

Crypto Trader - This participant may use GOLD for cryptococcal volatility hedges, as described in the white paper. GOLD can also be used to convert cryptocurrency to fiat.

Standard investor - This investor might want to buy GOLD as a cryptocurrency or as a type of security.

E-commerce and individual entrepreneurs - GOLD can be used to pay for goods and services. Low volatility as an asset and predictability makes it an invaluable currency.

Bank - GOLD cryptoassets gives new bank opportunities. There is free liquidity and extra earning potential from gold trading to fiat and vice versa. The use of cryptocurrency has become a major industry. Banks can benefit from earning standard commissions, gold deposit commissions, and using the GoldMint cash management system. At the same time, banks that invest in GOLD reinforce the reputation of GOLD, which increases their profits. The Bank also earns a commission to participate in the GoldMint partner program.

Currently, the overall crypto-cardiac circulation has exceeded $ 700 billion per year and a commission for deposits and withdrawals of more than 5%.

If the bank sets a lower commission to buy / sell GOLD for the client, most transactions (cryprocurrency deposit and withdrawal) will shift from an underground exchange to the bank. At the same time, integration with GOLD is only required, while all other cryptoexchange can be purchased directly.

The Bank also has revenues from cash management and commissions charged to gold deposited by the GoldMint company. Another source of income for banks is revenue from partner programs that include adding GOLD's digital assets to the bank's wealth management department's product line.

How it works

Digital gold gives its users a number of opportunities by combining the superiority of precious metals on the one hand and digital cryptassasses on the other.

Hedging Risk

Traders, investors and others who use crypto can use stable GOLD coins to protect risks and save their savings from volatility and dramatic price changes.

Units of exchange

Low volatile GOLD Kriptoass can be used as a payment unit for both companies and individuals. The core of digital assets makes them a fast, transparent and secure currency.

Investation

Two scenarios of the GoldMint trust management of kriptoasset assure investors with a 10% annual ROI in gold and are a transparent investment tool.

Loans Charged on GOLD

Individuals and companies can get loans in fiat currency imposed on crypto of their GOLD assets. Credit cards with partner banks are transmitted for this purpose.

The GoldMint company emits GOLD digital assets by itself and ensures their repurchase at current gold prices. Physical gold and ETF guarantee the ability to pay GoldMint companies. The assets are bought and sold in accordance with the volume of GOLD emitted. At the same time, the company's assets evaluated at 999 ounces of gold standard always equal or exceed the number of EMAS tokens emitted.

Here are the details of ICO:

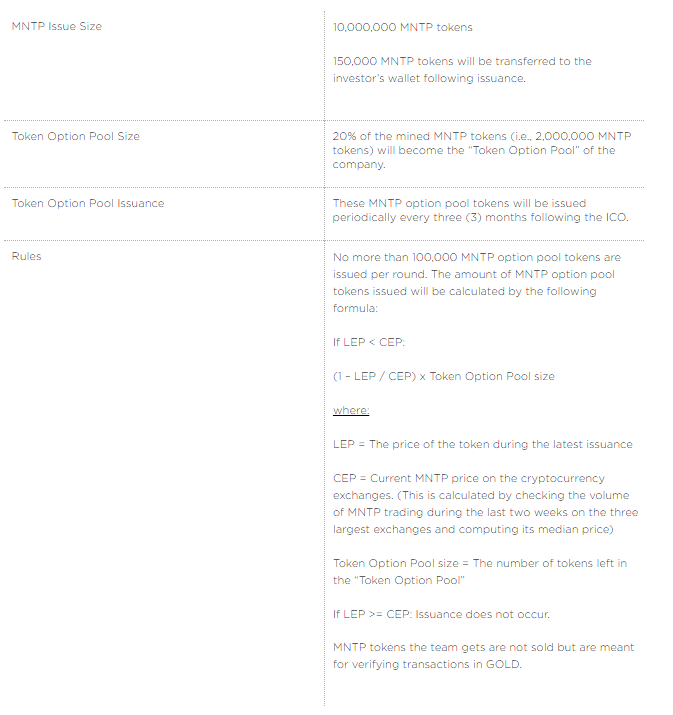

ICO Investors are tagged MNTP (MNT pre-launch) which can be converted to MNT after GoldMint has mine enough GOLD to independently support its platform.

The MNTP token will be moved to the GoldMint block cap and converted to MNT in 1: 1 proportion.

Close ICO will be set up within 15 days before ICO.

The minimum cap for ICO is 150,000 MNTP. If less than raised, investors receive back their funds. The MNTP token is released when the token is distributed about a month after the ICO begins.

Business model

GoldMint receives most of the revenue from:

GOLD transfer commission

GOLD security loan commission.

Revenue from physical gold exchange to GOLD.

Revenue from the use of Personal custody and Franchise Bot.

Most of the GoldMint fees come from the following:

Legal and tax costs

Staff - Development, marketing, business development.

Cost to participate in conferences, travel.

Marketing and Public Relations

Holding assets in gold - Payments for storage and management (for ETFs)

The cost of etereum

Development of Bot Custody

Tax

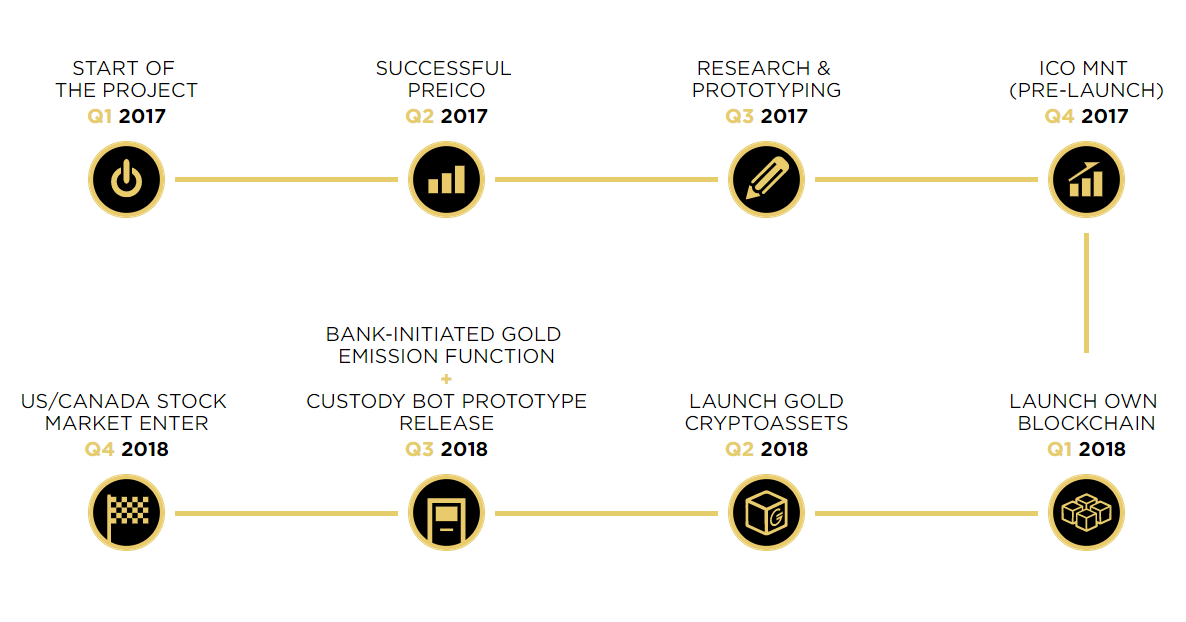

work schedule

Budget

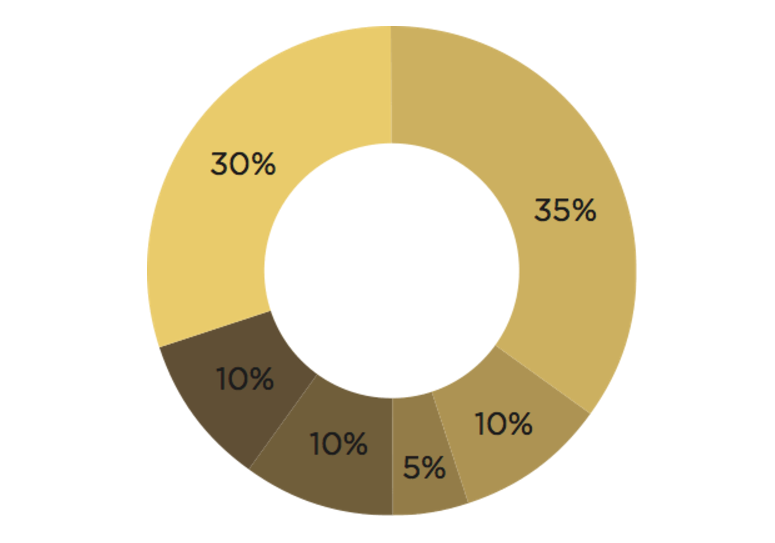

30% Marketing

35% Development

10% Team

10% Staff expansion

The other 10% are colleagues

Informasi Detail

Website: https://goldmint.io/

Whitepaper: https://goldmint.io/white-paper

Facebook: https://www.facebook.com/goldmint.io

Twitter: https://twitter.com/Goldmint_io

Telegram: https://t.me/goldmintio

My bitcointalk: Peot

https://bitcointalk.org/index.php?action=profile;u=1137199

https://bitcointalk.org/index.php?action=profile;u=1137199

Komentar

Posting Komentar